About Us

AAN Advisor Global offers investment consulting services and customized wealth management solutions to companies and financial institutions.

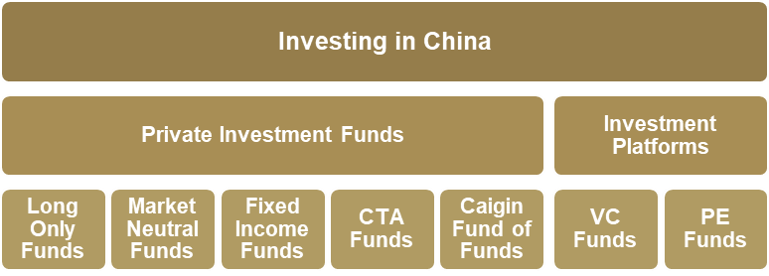

Driven by a team of talented professionals, we are committed to achieving absolute returns that are aligned with your long-term financial goal. We invest our clients funds in both developed markets and emerging markets and help build multi-currency, multi-asset class portfolios that allows for the long-term risk-adjusted returns.